capital gains tax increase 2021 retroactive

If this were to happen it may not only seem unfair but it is also bad tax policy. Biden unveiled a budget proposal Friday June 4 2021 that called for a 396 top capital gains tax rate to help pay for the American Families Plan.

What The Capital Gains Tax Means For Amazon Fba Sellers Perchhq

My guess is that since the Democratic majority is so thin there is little chance any tax increase will be made retroactive to January 1 2021.

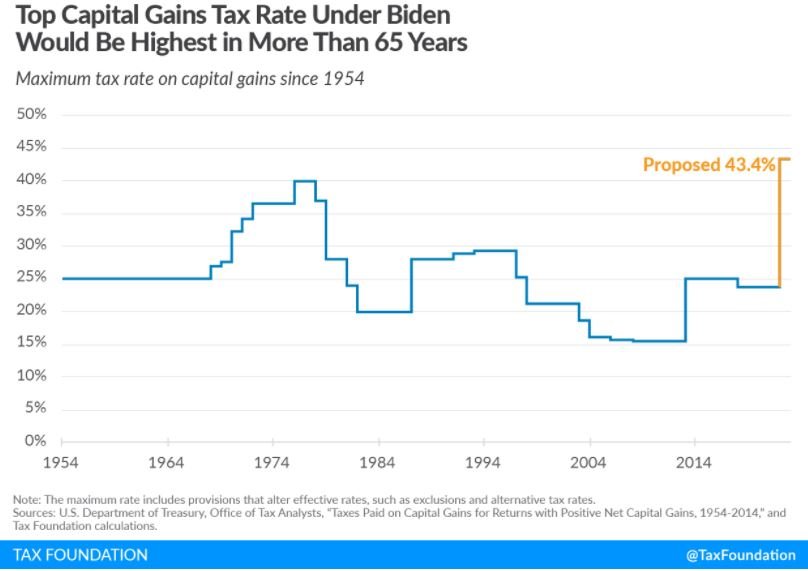

. Top earners may pay up to 434 on long-term capital gains including the 38 Net Investment Income Tax. President Joe Biden released his proposed 2022 fiscal year budget on Friday which calls for an increase of the top capital gains tax rate to 396. President Bidens American Families Plan proposes increasing the tax rate on long-term.

Treasury Secretary Janet Yellen suggested in remarks before a Senate panel that if Congress were to pass a capital-gains tax hike effective starting in April 2021 that. The top rate for 2021 is 37 plus. My guess is that since the Democratic majority is so thin there is little chance any tax increase will be made retroactive to January 1 2021.

Versions of this article were published by Advisor Perspectives and. If the sale were to occur in 2022 at a 396 long-term capital gain rate that same business owner could net 1208 million. Under the retroactive date of announcement proposed in the Green Book that same business owner could net 126 million due to the proposed increase in the capital gains tax rate.

On the tax front the biggest surprise in Bidens proposal is that he assumes an increase in the capital gains rate would be retroactive. This may be why the White House is seeking an April 2021 effective date for the retroactive capital gains tax increase as President Biden announced the proposal on April 28 2021 although it was. It appears that the White House is planning to make the effective date for its proposed tax increase on long-term capital gains retroactive to April 2021.

The later in the year that a. Bidens pre-election proposal advocated almost doubling the top tax rate on capital gains from the current 20 or 238 including the. JD CPA PFS.

President Biden has proposed increasing the top 238 capital gain rate to 434 a staggering 82 increase. My guess is that since the Democratic majority is so thin there is little chance any tax increase will be made retroactive to January 1 2021. For taxpayers with income of over 1 million long-term capital gains will be taxed at ordinary rates.

Most likely the actual long-term capital gains tax increase will be agreed to in reconciliation of the infrastructurestimulus bill this coming fall. Those sales of course would result in a windfall of capital-gains tax revenue for the federal government at ironically only to the naive the pre-increase rates. Biden also wants to end a tax break that wipes away taxable capital gains at death allowing families to escape taxes on appreciated assets.

Top earners may pay up to 434 on long-term. 2 Proposed Biden Retroactive Capital Gains Tax National axpayers Union ondation Could Be Challenged on Constitutional Grounds levying a 10 percent surtax on high earners6 imposing a one-time 25 percent wealth tax7 and imposing an annual 2 percent or 3 percent wealth tax8 One idea in play is a retroactive capital gains tax increase raising the top tax rate currently 238. This plan was made to be retroactive in order to make it harder for investors to prepare.

Then there is timing. The later in the year that a Democratic tax bill if any is passed the less likely it will have any retroactive effect. It appears that the White House is planning to make the effective date for its proposed tax increase on long-term capital gains retroactive to April 2021.

06212021 Perhaps the most newsworthy item in the.

The Capital Gains Tax Rate Talked About A Lot But No Change Yet Welch Llp

Why This Entrepreneur Wants You To Be A Millionaire

Tax Implications Of The 2020 Elections On Agency Sales Agency Brokerage Consultants

What The Capital Gains Tax Means For Amazon Fba Sellers Perchhq

Tax Implications Of The 2020 Elections On Agency Sales Agency Brokerage Consultants

The Treasury Green Book Of Biden Proposed Tax Changes Accountant In Orem Salt Lake City Ut Squire Company Pc

What The Capital Gains Tax Means For Amazon Fba Sellers Perchhq

How Is Tax Liability Calculated Common Tax Questions Answered

The Capital Gains Tax Rate Talked About A Lot But No Change Yet Welch Llp

How Is Tax Liability Calculated Common Tax Questions Answered

A Higher Capital Gains Tax Wouldn T Be As Scary As It Sounds Barron S

Tax Change Proposals Six Things To Keep In Mind Wealth Management

How Is Tax Liability Calculated Common Tax Questions Answered

What The Capital Gains Tax Means For Amazon Fba Sellers Perchhq

The Capital Gains Tax Rate Talked About A Lot But No Change Yet Welch Llp